Food prices keep soaring as UHM reiterates call to stop taxing COLA

The sharp increase in food prices is showing no signs of abating, despite indications that inflation is gradually starting to ease. Latest official data published by the National Statistics Office shows that even though the overall rate of inflation (retail price index) between February and August declined from 7.1% to 4%, food prices kept soaring by very worrying margins with a 9% annual margin when compared to August 2022. Such trend does not bode well in the fight against poverty as food expenses eat up a large chunk of the income of low-income households. However, the extent of the increase which has been going on for almost two years is also having significant impacts on the so-called middle class which is starting to feel the pinch.

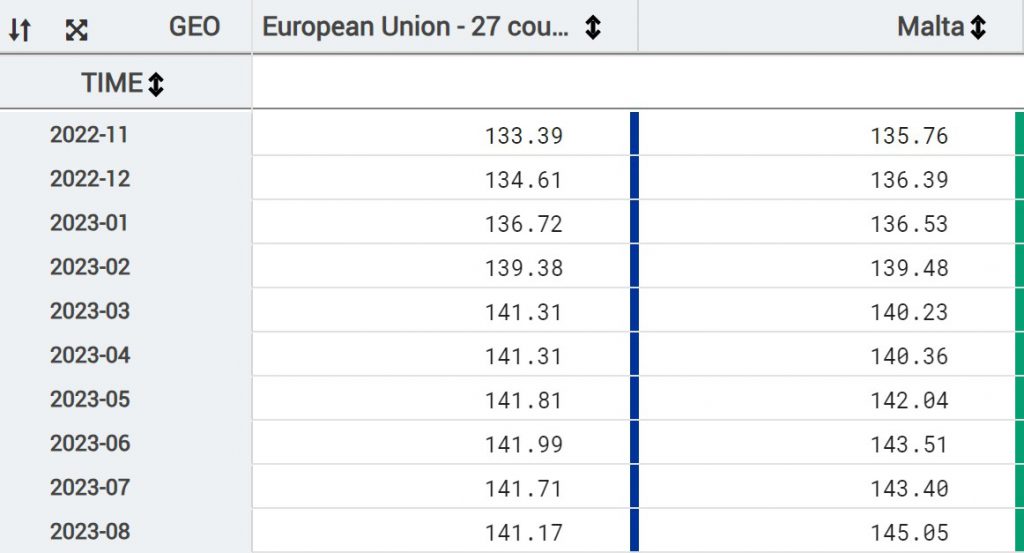

From a wider perspective, food price inflation in Malta has been consistently higher than the EU27 average since May and more worryingly the gap (in terms HICP) has been increasing month after month to almost 4 percentage points. This discrepancy is emerging despite the fact that the government has been forking out millions to subsidise grain, wheat and animal fodder in a bid to mitigate price hikes of essential items like bread, dairy products, poultry and meat. According to the 2024 pre-budget document from the onset of the war in Ukraine until June this year, government has subsidised this sector to the tune of €16.9 million.

UHM Voice of the Workers has been for a number of years insisting that the compensation due for the increase in the cost of living (COLA) should not be taxed. Though the exact amount for 2024 is yet to be determined, on the strength of the RPI data for September, the weekly increase will be in the region of €13 which would be in excess of an annual wage rise of €600. However, very few employees will be getting this amount as with the exception of those with very low income, the rest of the workforce will be taxed on this increase meaning that the majority will getting 75% of this amount or even less. This translates to €9.75 weekly or €507 annually.

Addressing social partners during the 2024 pre-budget launch, UHM CEO Josef Vella remarked that taxing workers on the compensation they are due for the increase in the cost of living for the previous year was socially unjust and tantamount to double taxation. Vella renewed his call for government to explore ways and means to phase out such practice.

Along the years the UHM’s proposal has found the backing of the Nationalist Party and most recently the Chamber of Commerce and Industry. The 2024 Budget is due on October 30.