‘COLA and NI should not be taxable’

UHM proposal would alleviate impact of cost of living

Employees should get the entire cost of living allowance as at present part of this compensation is never reaching their pockets as it going to government’s coffers as tax, the UHM CEO told parliament.

Josef Vella was addressing the Family Affairs Committee which is debating the impact which the record inflation is having on households. UHM Voice of the Workers was invited to deliver a presentation which focused on an ongoing study on inflation of essential supermarket items. The discussion also focused on possible measures which could be adopted to fight inflation.

“Part of COLA is being deducted as tax which means that a chunk of the compensation for the increase in prices for the previous year is not being awarded. This is akin to an employer who refuses to refund all work-related travel expenses to workers, like for example when going to Gozo, on the grounds that part of this refund goes as administrative tax,” Vella remarked. He added that exempting COLA from tax would be a measure which would boost workers’ spending money without resorting to increasing salaries.

Similarly, the UHM CEO proposed that the social security contribution should not be part of the employees’ taxable income.

“At present workers are paying tax on the NI even though this money never reaches their pocket. Consequently, on a median wage of around €20,000 per year, employees could benefit from an increase of around €500 if the NI is not taxable”, he pointed out.

If such measures would have been adopted this year, they would translate to around an increase of €1,000 in the take-home pay. Alternatively, the government could also opt to start introducing these measures gradually over a number of years in order to mitigate any possible losses in revenue.

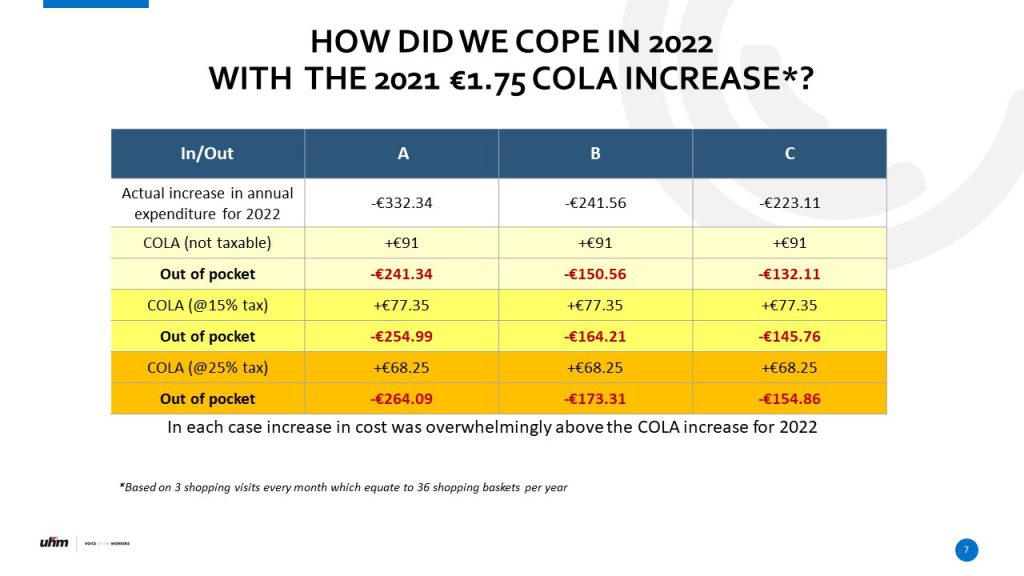

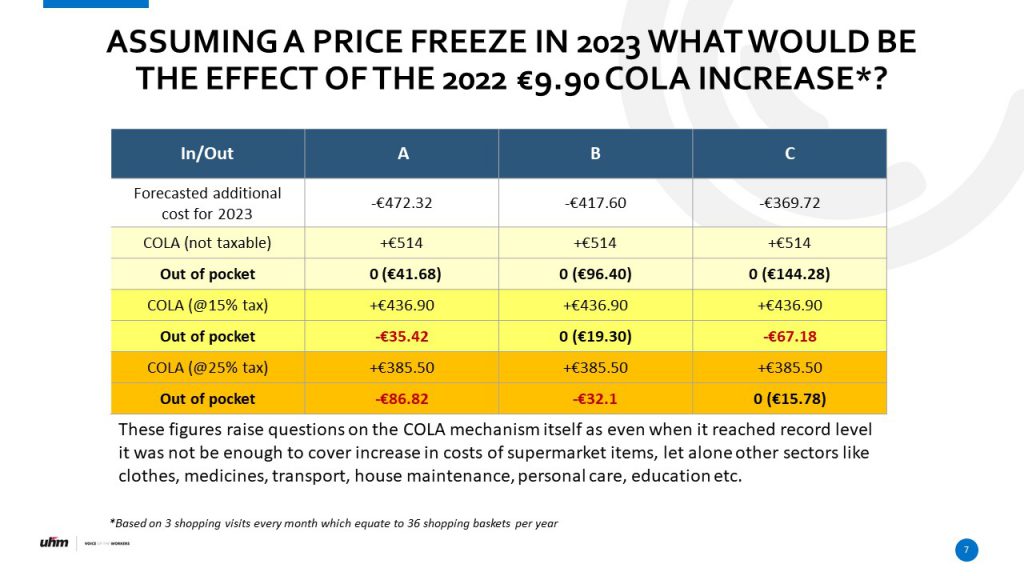

According to the UHM study prices at the three main supermarket chains in the Maltese Islands rose by 8.6% in just a year. While this increase alone devoured the €1.75 COLA increase awarded in 2022, it is estimated that even in 2023 when the increase is of €9.90, this will barely be enough.

“In the context of this research the questions beckons: If the €9.90 was not even enough to cover food prices alone, when it is supposed to compensate also for sectors like clothing, medicine, house maintenance and education among others, are we sure that this mechanism is truly reflecting the increase in the cost of living?. This is why the COLA mechanism needs to be revised and function in a transparent manner in terms of the basket of items it contains.”

From this study it is estimated that in 2022 the cost of supermarket items increased between €223 and €332 per year. As for 2023, if we had to assume that prices would remain unchanged, the increase in cost would vary between €370 and €472 over an entire year. Given that the €9.90 COLA equates to €514 per year this would barely be enough. In reality however, the situation would be tighter as those paying 15% tax would receive €436, while those being taxed at 25% would only get €385 rather than €514.

Watch the entire meeting here.