Introducing My ĠEMMA Savings Goal Tracker

Download the ĠEMMA savings goal tracker by clicking here

First you need to set your savings goals. What are you saving for? Your savings goals may be for carrying out maintenance on your home or redecorating your daughter’s bedroom. You may be saving for a family vacation. You may be saving for retirement or for a rainy day fund. You may be saving for all of these reasons.

Once you know what you are saving for, it is important that you determine how much money you need to save each month in order to reach that each goal. Tally up all of your monthly savings goals into a lump sum. You will need to find that amount of money in your budget – money will you set aside so that you meet your savings goals.

The ĠEMMA Savings Goal Tracker helps you do this. Hereunder we explain the ĠEMMA Savings Goal Tracker.

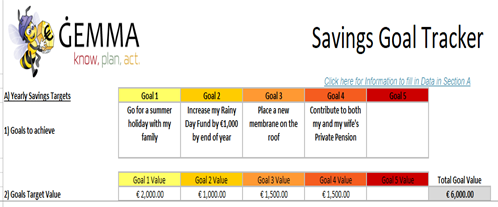

Section A-1: The Savings Goal Tracker allows you to track up to 5 goals. To list your goal click on ‘Goals to Achieve’ for any one of the goals. To insert the Goal Value you are to click on ‘Goals Target Value’ for any one of the goals. In the example below, Goal 1 is a family summer holiday, whilst the Goal Value is €2,000 – that is the € saving goal target you set for yourself.

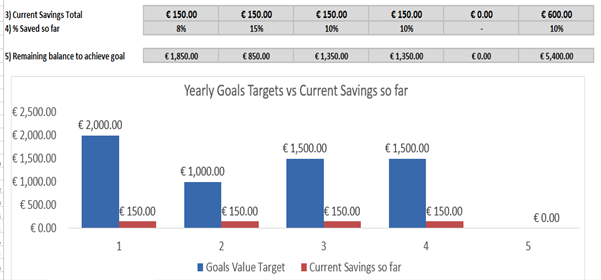

Section A-2: This is the Savings Goal Tracker. In this section you will be able to see how much you have saved for each goal, and the remaining balance you are yet to save to meet this goal. The bar chart provides you a quick view of where you stand vis-a-vis meeting your goal.

Section B: This is you Saving Management Planner. In this section you determine the monthly savings you will put aside so that you are in a position to meet your saving goals and how you are to apportion these monthly savings. In this example you have decided to save €600 a month.