Introducing the My ĠEMMA Savings Calculator

Download the ĠEMMA calculator by clicking here.

This Calculator helps you to work out the following:

- Your total savings including interest earned from the day you start to invest.

The period during which you save is set to a maximum of 45 years. The calculator allows you to set the first amount you will deposit and the monthly additional savings you will make.

You also set the annual rate of return.

- It is important for you to note that inflation will over time reduce the purchasing power of the money you saved. Ideally you protect your savings against inflation – but this is not always possible. For example, today, the average interest rate on savings accounts has hovered well below 1% for the past several years – lower than the rate of inflation. This means that over time the purchasing value of your savings will erode.

The calculator asks you to determine the rate of inflation. The calculator works out the inflation impact over the period in which savings occur.

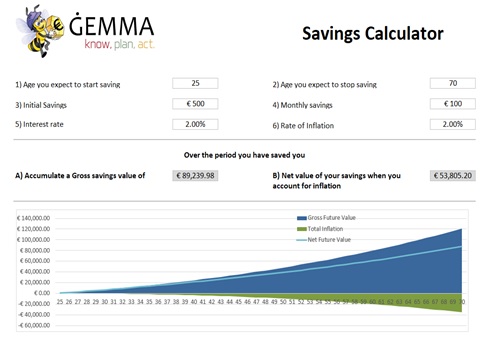

In the example below you expect to be in a position to save between 25 and 70 years of age. Your first saving is €500 with additional monthly savings averaging €100 / month over the period. The chart below shows you how your savings will accrue over the period. The total savings, including interest, is estimated at €89,239. This is shown as ‘Gross Future Value’.

The impact of inflation on your savings is shown in the chart titled ‘Total Inflation’. ‘Future Net Value’ shows you the actual purchasing power of your savings compared to today. So, whilst you would have saved nearly €90,000 over 45 years the impact of inflation means that your actual spending power compared to today is only €53,805.