No balanced budget before 2027, higher debt for the next decade

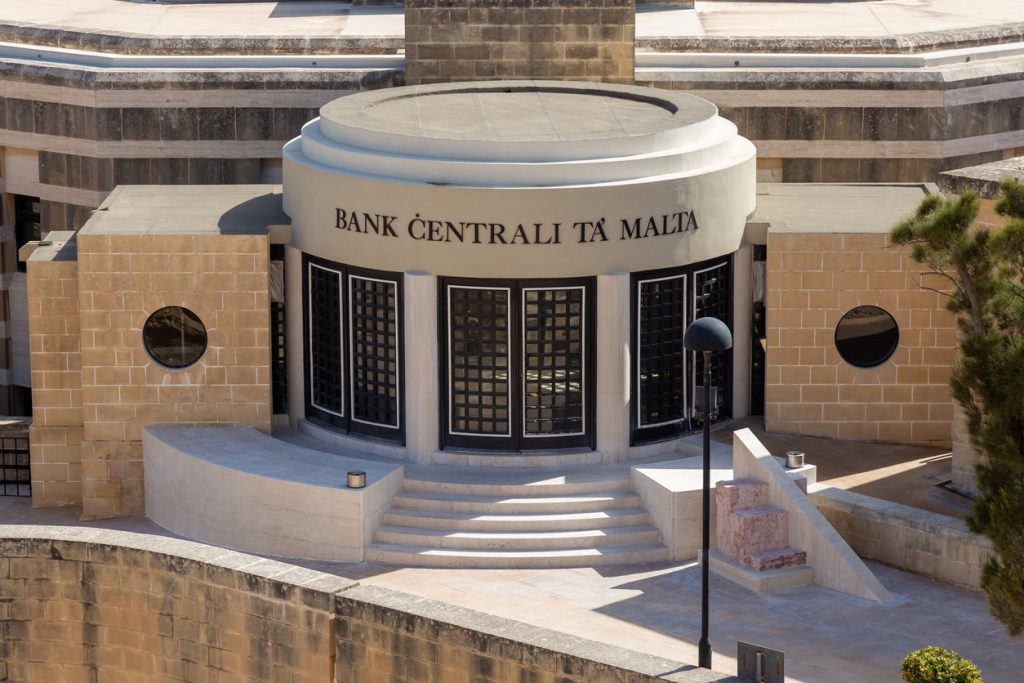

Malta’s national debt will remain above the pre-pandemic level for the next decade while it will take at least until 2027 to achieve a balanced budget, the Central Bank of Malta has said.

These projections were presented in the 2021 annual report which included an in-dept analysis on the sustainability of Malta’s debt by presenting two different scenarios. Though the debt-to-GDP ratio “is not expected to embark on an explosive path” it can nonetheless “be explosive in periods of prolonged large fiscal deficits, coupled with a shock in GDP growth”. It transpires that the debt ratio will remain above that in 2019 at least until 2031 but this depends also on the pace of Malta’s economic recovery and fiscal consolidation. The possibility of additional Covid-19 measures, subsidies on energy costs, the War in Ukraine, State aid to Air Malta and the rent reform will have a huge bearing on the matter.

Scenario 1

In this scenario the fiscal deficit targets until 2024 follow the projections of the Central Bank and additional consolidation measures are implemented between 2025 and 2027. A balanced budget is achieved by 2027 and small surplus is posted in subsequent years. Based on these assumptions and excluding the impact of any shocks, government’s debt is expected to peak in 2024 before declining to around 47% of GDP by 2031.

Scenario 2

In this scenario it is assumed that fiscal consolidation is not pursued so aggressively, whereby a looser fiscal stance is adopted. If such approach is followed the debt ratio could reach just under 65% by 2027 and remain broadly stable thereafter. Moreover, since government is assumed to retain a deficit each year, the debt ratio would be expected to be 73% by 2031.

Possible risks

In its analysis the Central Bank outlines several issues which could have a bearing on Malta’s debt in the next decade. These include possible further measures to support industry recover from the pandemic and mitigate the sharp rise in fuel prices. In this respect, the finance minister has already announced that €200 million allocated for this year to keep energy prices stable have been used up, meaning that the overall bill will be much higher than expected.

Other possible threats are posed by the situation at Air Malta where government is seeking Brussel’s green light to inject further money from the State’s coffers to save the ailing national airline.

The report also refers to the rent reform of pre-1995 leases which will affect up to 10,000 households. Under this reform government will be forking out any additional costs which might be incurred by the tenants should the revised rent exceed 25% of their income, and in the case of the elderly and social welfare beneficiaries the entire increase. Since any rent increases need to be determined on a case-by-case basis by the Rent Regulation Board, the fiscal impact of this reform cannot be ascertained at present, the Central Bank said.

Other possible risks outlined in the report include the change in Malta’s corporate tax regime as part of an EU-wide streamlining process and the possibility of new EU measures to raise the bloc’s budget to cover the extraordinary expenditure incurred to roll out the Covid-19 rescue package.