Introducing the My ĠEMMA Compound Interest Calculator

(Download the ĠEMMA calculator by clicking here)

The compound interest principle is one of the most important principles in money management. Compound interest and time are your most effective strategy tools to accumulate savings. Even small deposits to a savings or a retirement plan started early and invested over the long term will significantly add up over time.

Compound interest can be defined as the addition of interest calculated on the initial savings or investment (the technical word use is ‘principal’) – or interest on interest. Compound interest, therefore, is different from simple interest.

Simple interest You deposit €1,000 in Year 1. The interest rate is 2.5%, and interest earned is €25.

Compound Interest As above. But you re-invest the principal invested (€1,000) and the interest earned (€25). You keep re-investing the principal earned and the interest accrued for 25 years. At the end of the 25 years, the interest will increase from €25 in Y1 to €45.22 in Y25. Your initial investment at the end of the 25th year increases from €1,000 to €1,853. The interest accrued on your investment is €853.

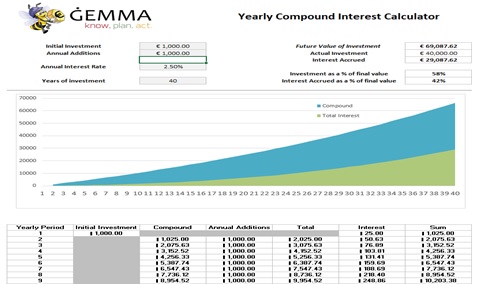

The Chart shows you how the calculator looks. The following example is used. At the age of 25 years you decide that you will invest €1,000 every year for 40 years – up to when you reach the age of 65 years and plan to retire.

The interest accrued during this 40 year period is shown in green in the Chart below. The annual savings and interest accrued is shown in the Chart as the green and blue components respectively.

Over a period of 40 years you will have saved €40,000 and accrued €29,087 in interests – resulting in a total of €69,087. The interests accrued are 42% of your total investment. The calculator also provides you with a Table showing how the compounding is accrued. The table provides the compound calculations for up to 50 years – to show you, and hence emphasise, the powerful impact that compound interest and time have on your investments.