Consumer confidence plunges as cost-of-living dents expectations

Consumer confidence in the Maltese Islands continued to decline as households expressed concern on their general financial outlook, the Central Bank has announced.

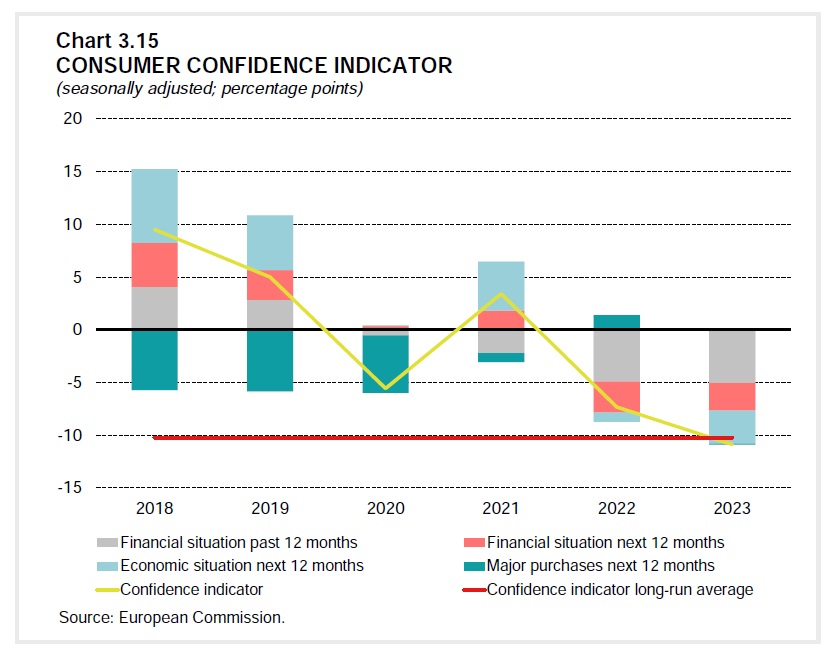

This indicator measures the overall feeling with respect to households’ assessment and expectations of their financial situation, the general economic situation and their intention to make major purchases over the subsequent 12 months.

It transpires that in 2023 consumer confidence declined to -10.9, from -7.3 in 2022 and 3.4 in 2021. Moreover, the drop has resulted in the overall level falling below the long-term average of -10.3.

The Central Bank noted that the fall in sentiment, when compared to 2022, largely reflected a deterioration in consumers’ expectations of the general economic situation over the next 12 months. At the same time, households, on balance, signalled that they did not intend to undertake major purchases in subsequent months.

This contrasts with 2022, when expectations of major purchases stood positive. Furthermore, while consumers assessment of their finances over the last 12 months worsened, expectations of their financial situation improved but remained negative.

Additional survey information suggests that in contrast to 2022, respondents expected unemployment to rise in the following 12 months. Meanwhile, savings expectations edged down compared to a year earlier, but remained positive. The survey also reveals that inflation perceptions increased, reaching unprecedent levels, while price expectations eased but remained elevated.

Though there are a host of factors which negatively impact consumer confidence, in the case of Malta the likely causes are probably related to the sharp rise in the cost of living which has eaten savings, increased expenses and consequently eroded the quality of life. Such a scenario triggers apprehension and a sense of uncertainty, to the point that households start cutting back from ‘unnecessary’ spending to ensure they have some money in case of a rainy day. Furthermore, housing affordability is having is dampening expectations as more and more young people are less confident of being able to purchase their first property due to the increase in price in the real estate market.

Meanwhile, the Central Bank reports that the level of confidence in construction decreased but remained positive.

The sentiment indicator for the construction sector averaged 1.2 during 2023, down from 7.0 in the preceding year. Notwithstanding this decrease, confidence remained firmly above its long-term average of -8.1. Respondents assessed order book levels to be below normal levels in 2023, compared with a positive assessment a year earlier. Meanwhile, employment expectations for the next three months stood more positive Additional survey data show that respondents’ assessment of building activity over the past three months turned negative. Furthermore, insufficient demand and financial constraints were the most important impediment to production signalled by respondents during the year under review, followed by labour shortages.