Introducing the My ĠEMMA Savings Programme Withdrawal Calculator

Download the My ĠEMMA Savings Programme Withdrawal Calculator by clicking here.

Early on in your mid-20s you took the decision to start planning for your retirement – by saving in a retirement plan and later after you paid the mortgage and the kids left the nest by saving in a bank account.

A decision to plan for retirement is a decision that seeks to ensure that you enjoy a quality of life that is similar to that you enjoyed whilst employed. In doing so, through your retirement nest you will complement your social security contributory pension income.

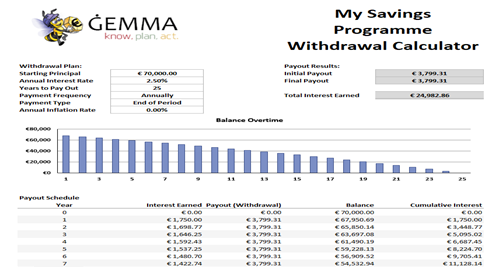

So, let’s assume that by the time you retire at 65 years of age your retirement nest egg is €70,000. The following are planning considerations that you may consider on how you are going to plan the use of these savings during retirement:

- Will draw down up to nearly 90 years of age

annual draw down of €3,800

- Will draw down up to my life expectancy (79 years of age)

annual draw down of €5,987

- Will draw down up to my healthy life expectancy – 74 years of age

annual draw down of €8,792

As you can see from the above Table, depending on the decision you take you can increase your pension income as a result of your savings by €3,800 to €8,792

You are able to draw this amount as over time your retirement post is being annually topped up by a compounded interest. The amount of top, however, decreases from year to years as your savings decreased as a result of the programmed withdrawal.