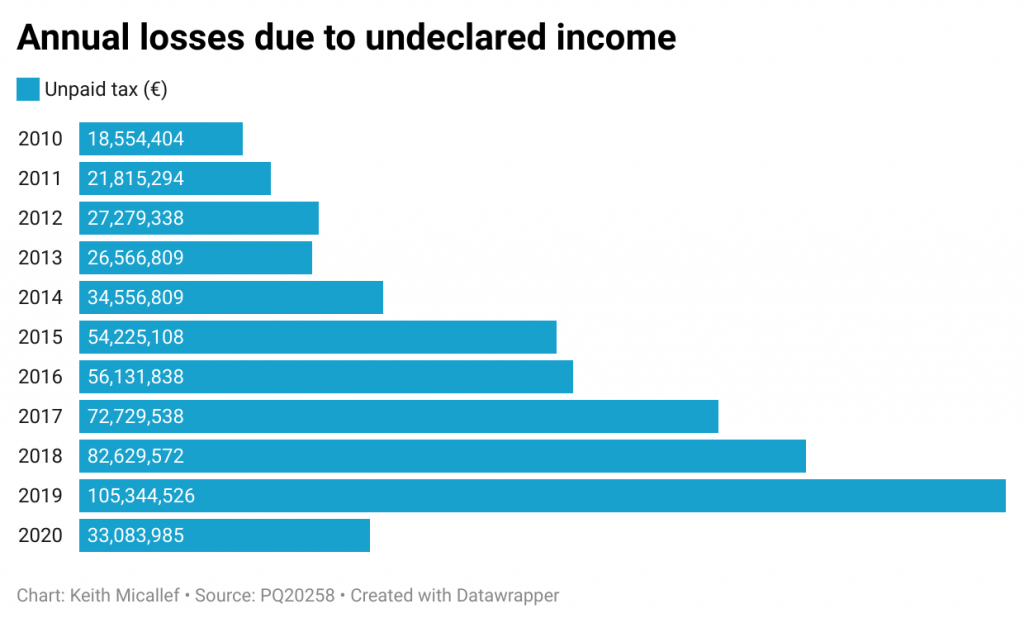

Undeclared income cost exchequer over €500 million since 2010

Over €500 million in income tax was lost in the last decade alone as a result of undeclared income. It transpires that between 2010 and 2020 there were 201,364 individuals who did not file their income tax declaration with the overall amount of tax due estimated at €533 million. The staggering figure was divulged in parliament by Finance Minister Clyde Caruana in reply to a series of parliamentary questions by Opposition MP Jason Azzopardi.

The data shows a steady annual rise in the number of people not declaring their income. A deeper analysis of the figures reveals that there was a spike between 2017 and 2019 when the number of individuals undeclaring their income hovered around 27,000 per year with the estimated income tax due reaching €105 million in 2019 alone. What followed in 2020 was rather unprecedented as there was sharp drop in undeclared earnings with the number of undeclared cases dropping to 8,000 exactly and the respective value in income tax due declining sharply to €33 million.

In his reply, the finance minister attributed the steady rise between 2010 and 2019 to the influx of foreign workers and cases of repeated entries of those who failed to submit their returns more than once.

As for 2020, the finance minister insisted this sudden drop was due to “adjustments” made in the computerised system of the Inland Revenue Department. The change was justified in the wake of the influx of foreign workers who were either unaware of their obligation to file their income tax returns or else returned to their home country before doing so. Consequently, “adjustments” were made for 2020 whereby the information is being sought directly from the employers.

Asked on the steps taken to recoup this lost revenue the finance minister said that between 2010 and 2020, 290,231 individuals were fined for failing to file an income tax declaration at all or pay the tax due. The overall amount of these fines was of €54.3 million which was well below the estimated losses which ran into hundreds of millions.

It also transpires that €35.6 million in fines were issued for omitting part of the income in the tax returns. The figures does not include 2020 as the data is still being compiled.

By law late payments in tax trigger interest charges. In this case, between 2010 and 2020 this provision was applied to 302,300 individuals of whom only 112,460 paid the interest due while the rest had a pending balance at the end of each year.

Nothing is certain but death and taxes, as the saying goes, but Malta seems to be the exception.