MEPs clear another hurdle for the COVID-19 recovery plan

The European Parliament has approved three laws on implementing the EU’s Own Resources system, paving the way for its reform and the introduction of new sources of EU revenue.

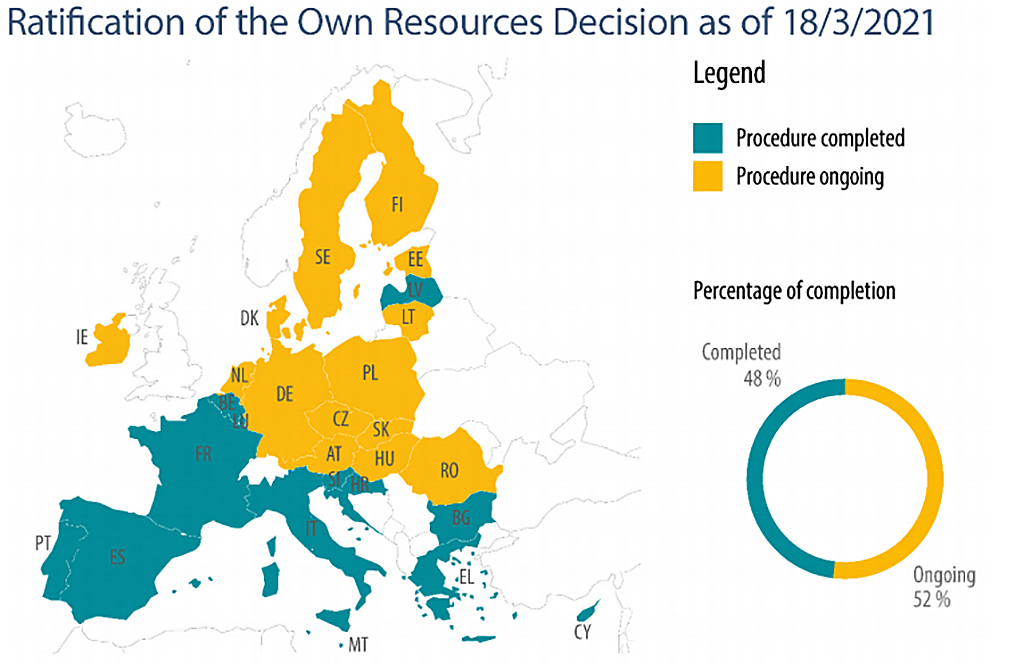

MEPs adopted one implementing and two operational regulations on which methods to use to collect or make available specific Own Resources, which constitute the revenue for the EU budget. The three laws work in conjunction with the key Own Resources Decision (ORD), approved by Parliament in September and by Council in December 2020. The member states are currently in the process of ratifying this decision, with 13 out of 27 having done so already as of 18 March (more information on the ratification here).

The approved regulations include provisions on calculating and simplifying the EU’s revenue, on managing cash flow, and on monitoring and inspection rights. These are needed to ensure the EU budget’s reformed revenue side continues to function smoothly.

Once member states have ratified the Own Resources Decision, the package adopted today will apply retroactively from 1 January 2021. It will introduce the new plastics levy as the first of various new streams of revenue that will be set up between now and 2026. The ORD will enable the EU to borrow €750 billion for the “Next Generation EU” recovery plan.

During the negotiations on the EU’s 2021-2027 long-term budget, MEPs obtained a binding roadmap for new sources of EU revenue. The three steps of the Own Resources roadmap are as follows:

- First step (2021): a contribution on plastic introduced in January 2021, new legislative proposals on a carbon border adjustment mechanism, a digital levy and the Emissions Trading Scheme will be submitted by June;

- Second step (2022 and 2023): Council will deliberate on these new sources of revenue by 1 July 2022 at the latest in order to be able to introduce them by 1 January 2023;

- Third step (2024-2026): by June 2024, the Commission will put forward a proposal for additional new own resources, which could include a Financial Transaction Tax and a financial contribution from the corporate sector or a new common corporate tax base. Council will deliberate on these new sources of EU revenue by 1 July 2025 at the latest in order to be able to introduce them by 1 January 2026.